Abu Dhabi, UAE – Emirates Development Bank (EDB), a key financial engine of economic development and industrial advancement in the UAE, has reported an extraordinary year of achievements and strategic milestones for 2023.

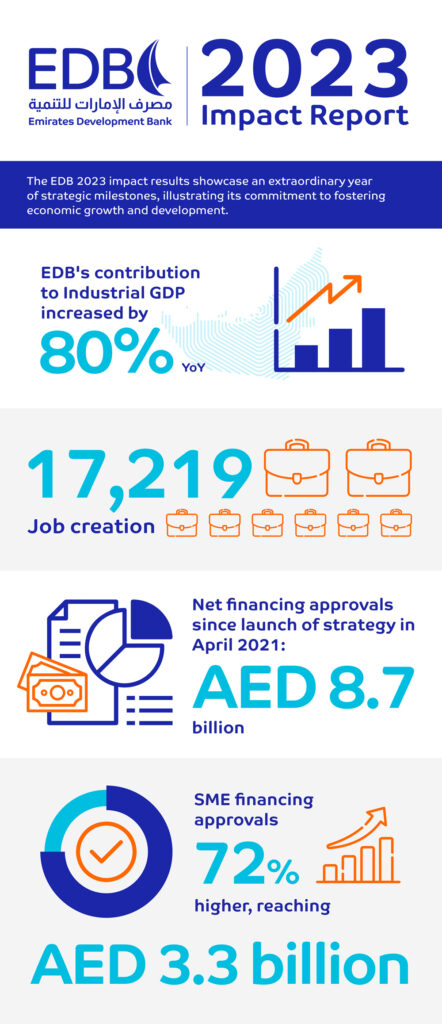

The Bank’s contribution to the UAE’s industrial GDP surged by a significant 80%, growing from AED 2.4 billion in 2022 to AED 4.3 billion in 2023. This growth has been accompanied by the creation of 17,219 jobs, demonstrating EDB’s commitment to fostering economic growth and development.

Dr. Sultan Ahmed Al Jaber, Minister of Industry and Advanced Technology, and Chairman of Emirates Development Bank, commented on the results, stating that the Bank’s dynamic strategy and innovative financing solutions have played a pivotal role in reshaping the UAE’s industrial sector. This has led to a remarkable increase in the industrial GDP impact in 2023, bringing the total of net financing approvals since the launch of EDB’s strategy in 2021 to AED 8.7 billion.

The Bank’s flexible financing solutions and patient debt approach have significantly bolstered industrial growth, SME support, and technological advancements, aligning with the UAE government’s strategic goals.

Ahmed Mohamed Al Naqbi, CEO of Emirates Development Bank, added that 2023 has been a milestone year for EDB in reinforcing its role as a key enabler of the UAE’s economic growth and industrial advancement. The Bank’s strategic emphasis on sectors crucial to the UAE’s future development has led to the deployment of innovative and sustainable financing solutions. This resulted in a significant 72% increase in SME financing approvals, totaling AED 3.3 billion, and AED 1.3 billion in financing approvals under the Credit Guarantee Scheme with partner banks.

EDB has set a clear goal to elevate its contribution to the UAE’s GDP to AED 10 billion by 2026, focusing on empowering the private sector to drive the nation’s economic growth.

Moreover, EDB has approved a total of AED 1.3 billion in financing under the Credit Guarantee Scheme with partner banks in the UAE, marking a 64% increase compared to the previous year. This reflects the Bank’s commitment to enhancing the financial inclusion of SMEs.

In line with the UAE’s climate goals and net zero ambitions, EDB launched five new programs with a total value of more than AED 500 million in financing, including two first-of-a-kind programs dedicated to financing agritech and solar energy projects.

The Bank has a mandate to approve AED 30 billion in financing support to 13,500 companies within five sectors – manufacturing, food security, healthcare, technology, and renewables – by 2026.