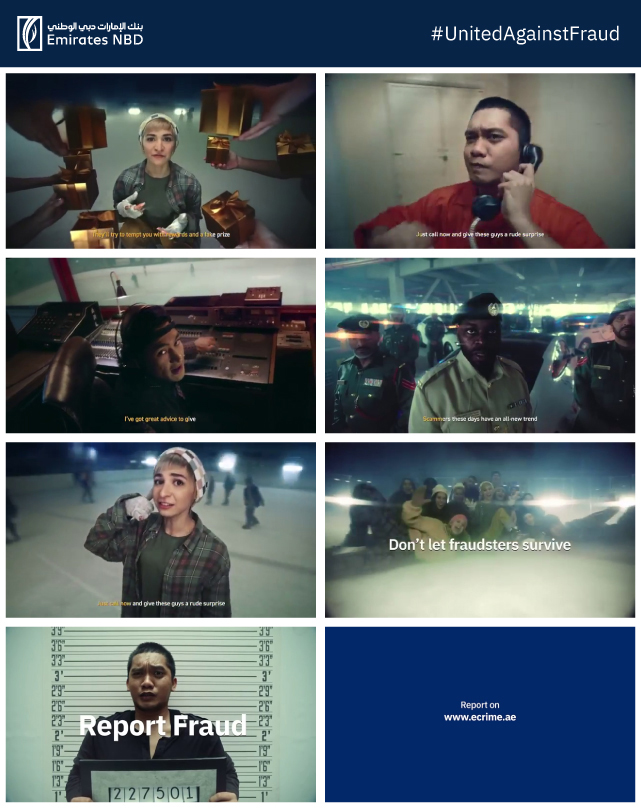

Dubai, UAE – Emirates NBD, a leading banking group in the MENAT (Middle East, North Africa and Türkiye) region, has announced further collaboration with Dubai Police and the Central Bank of the UAE to continue its efforts in raising awareness about rising scams and promoting safe banking practices as part of its #UnitedAgainstFraud campaign.

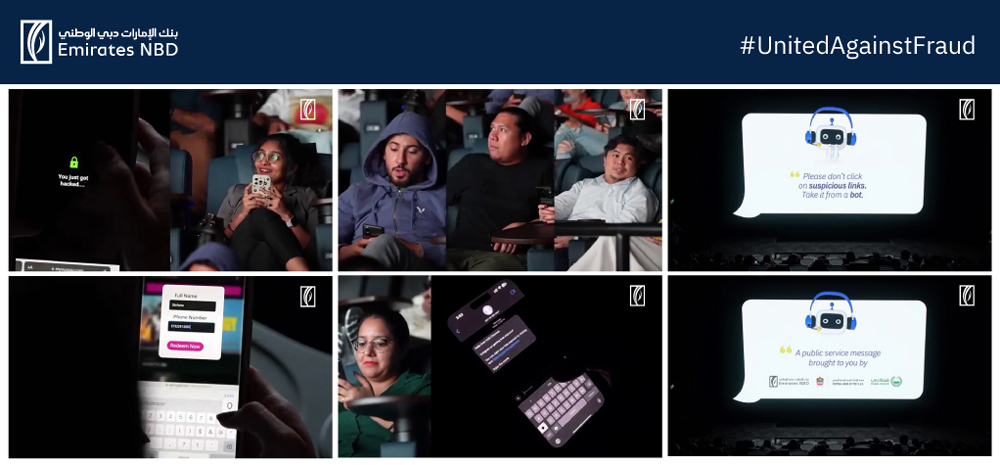

Using a unique and innovative approach, Emirates NBD’s most recent activation aims to raise public awareness and educate consumers about real-time scams, encouraging individuals to remain vigilant against fraudulent activities and actively report such incidents. The campaign featured a ‘fake’ scam activation at VOX Cinemas, involving a bot interacting with moviegoers before the film started. The bot offered them free popcorn via an SMS link, which nearly 90 percent of the audience clicked on, resulting in a simulated hacking experience on their smartphones. Following the activation, everyone in the cinema was rewarded with free popcorn.

With scammers and fraudsters increasingly utilising various platforms and sources to target victims, aiming to steal personal details, IDs, one-time passwords (OTPs) and banking information, Emirates NBD’s latest awareness activation raises awareness about how people should stay cautious of scams. By staying vigilant and alert, individuals can protect themselves from the risk of losing money or their personal identity. The activation saw an overwhelming response, reaching more than 5 million customers and garnering over 18 million impressions, with more than 3.3 million video views.

Ahmed Al Marzouqi, Head of Retail Distribution, Emirates NBD said: “Protecting customers from fraudulent activity requires more than just investing in digital assets and traditional email and SMS campaigns. Emirates NBD continues to develop impactful and memorable initiatives that effectively raise awareness within the broader community through relatable and innovative ways. As a leading national bank, we are committed to collaborating with industry partners to educate and empower individuals to recognise and combat fraud, thereby fostering a safer and more secure environment for all.”

To maximise reach, the #UnitedAgainstFraudCampaign targets the latest fraud trends through a wide variety of activations and tactics.

Notable and successful activations from the campaign included the Freej video campaign, where the bank teamed up with the much-loved characters from Freej to raise awareness among Emiratis about various types of fraud activities. The bank also released a five-part series of short videos, offering crucial tips on staying safe and emphasising the importance of due diligence. To reach a wider demographic, the bank collaborated with more than 20 influencers from diverse backgrounds including Sneha Rebecca, Taim Al Falasi, Just Food DXB and Sara Karrit to name a few, who shared videos and reels about the campaign on their personal channels to spread awareness. Additionally, the bank released customer testimonial videos on social media, showcasing real-life experiences and providing key insights on remaining vigilant against fraud. On International Labour Day, the bank organised an event for labourers focused on safe banking practices and educating customers on fraud prevention.

Leveraging radio as a popular platform, Emirates NBD partnered with five leading English, Arabic, and Hindi radio stations across the UAE to broadcast several ads for the United Against Fraud campaign. Additionally, the bank executed popular radio activations, including the ‘Prank the Call’ initiative on the ARN radio network, where an RJ impersonated an official in recorded calls to trick listeners into revealing private information, rewarding vigilant participants who did not fall for the scam. Another activation was ‘Spot the Fraudster’ on Channel 4 FM, where the RJ presented various scenarios, and callers had to identify which ones involved fraudulent activity, with rewards given to those who successfully spotted the scams.

The UAE authorities and Emirates NBD urge members of the public to report suspicious links or emails related to their bank accounts to their respective bank’s call centre and Dubai Police.